Direct deposit is the safest, fastest way to get your tax refund, and you can use your prepaid card. Here are 2021’s best tax refund cards.

According to the IRS, direct deposit is the “fastest, safest way to receive your tax refund.” The IRS reports that nearly 75% of taxpayers get a refund. And the vast majority of those had their refund deposited directly into a checking or savings account or a prepaid card. There are several advantages to direct deposit of a tax refund:

- You can get your refund much faster, typically in about 8 to 10 days;

- It’s more secure than getting a check in the mail. Thousands of refund checks are returned to the IRS each year;

- Direct deposit avoids expensive check cashing fees; and

- You can get access to the cash faster than depositing a refund check. That’s because you don’t have to wait for the check to clear.

Using Prepaid Cards to Receive Your Tax Refund

While the benefits of using direct deposit for tax refunds are compelling, some refund recipients don’t have a bank account to receive the refund. Or perhaps you’re just looking to separate refunds from their checking account. That’s where prepaid debit cards come in.

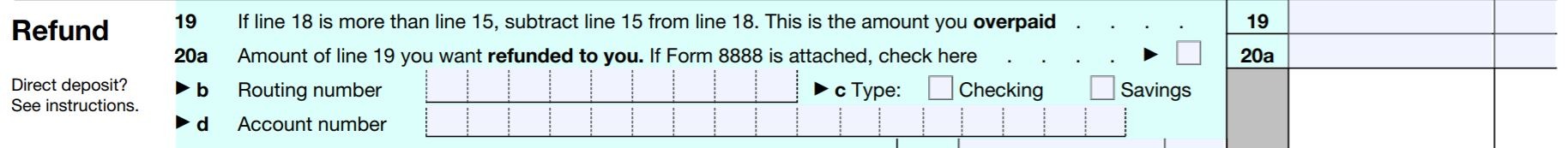

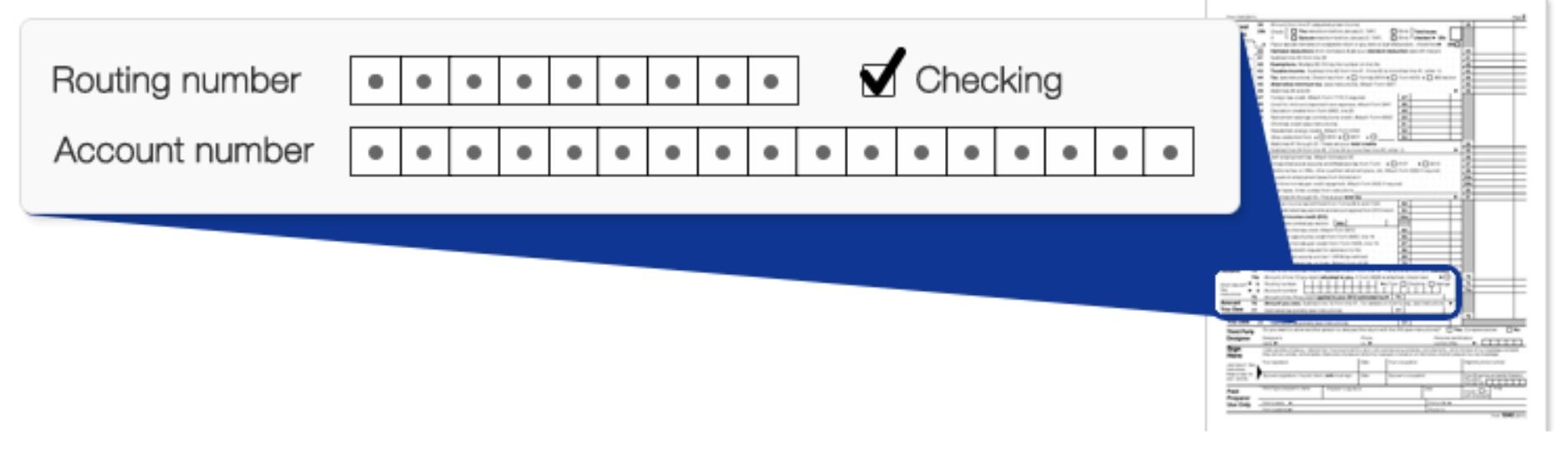

Prepaid cards can be used like bank accounts to receive tax refunds. The process is nearly identical. You just need to check the box on your tax return to receive your refund by direct deposit. Then, you fill in a routing number and account number for your prepaid card on line 20 of the 1040 Form.

You can find your routing number by signing into your prepaid card account. Just navigate to the direct deposit section on the web portal for your card. For some cards, you can also get your routing and account numbers by text. For a Netspend card, for example, you can text “DIRECT” to the Netspend SMS number, 22622.

Unlike bank accounts, however, prepaid cards have balance limits. All cards cap the amount that you can have on the card at any time. Those limits vary significantly among prepaid cards. So you’ll want to make sure your prepaid card has a sufficient card limit to receive your refund.

Tax Refund Prepaid Cards

While you can use most prepaid cards for tax refunds, some cards make it easier to set up than others. So we’ve cut through all of the marketing hype to create this list of the best prepaid cards for tax refunds. Our list also favors those prepaid cards that provide excellent instructions on how to set up the direct deposit for tax refunds. Amd focuses on those with card limits sufficient to accommodate them.

- Netspend: The Netspend® Visa® Prepaid Card does an excellent job of walking through the steps necessary to get your refund deposited onto a prepaid card. In addition to the routing number and bank account number, both of which are supplied once you get the card, they also walk through the steps to set up the deposit. The Netspend card has a generous $15,000 card balance limit–adequate for for most any tax refund. Plus, it offers a high-interest savings account to earn more money if you want to save that refund for later. And any amounts transferred to your savings account don’t count against the card balance.

-

Brink’s: The

Brink's Prepaid Mastercard® offers similar benefits to the Netspend card. It offers the same $15,000 card limit with a savings account to extend that limit. And it offers step-by-step instructions to set up direct deposit for your refund.

- H&R Block Emerald Card: The H&R Block Emerald Prepaid Mastercard® is the only card offered through a tax preparation software that makes the list. While the Emerald Card isn’t heavy on bells and whistles, it has no monthly fee. However, keep in mind that you can use any prepaid card to receive your tax refund. That’s true even if you use H&R Block (or their software) to prepare your taxes. So it’s still worth checking your options.

- FamZoo Prepaid Card for Teens: If you have a teenage child with that first job, you might check out the FamZoo Prepaid Card. It’s one of the only cards for teens that supports direct deposit for federal tax refunds. In addition, it has a number of other benefits for families with teens. The FamZoo tax refund setup is pretty much the same as its adult counterparts. Teens will need the routing and account numbers to enter on their tax returns. But parents will need to access the Famzoo web portal to get the numbers for them.

-

Walmart MoneyCard: For those who shop at Walmart regularly, its prepaid card is an ideal way to receive your tax refund. As Walmart points out, you can get your refund in as fast as 8 days with direct deposit. That’s compared to 28 days via check. The

Walmart MoneyCard® Visa® has some great benefits, like cash back rewards and a savings vault, in addition to offering a fast way to get your refund.

If you do use a prepaid card to get your refund, you can track the status of the direct deposit. Offered by the IRS, it’s called “Where’s My Refund.” You’ll just need your social security number, filing status, and the amount of your refund.