Bluebird by American Express–Low Cost, Good Features, but…

Bluebird by American Express is one of the lowest cost prepaid debit cards available. It’s even cheaper than Serve, American Express’s other prepaid card. But it isn’t as convenient as its Visa and Mastercard competitors.

American Express offers two prepaid cards–Bluebird by American Express and American Express Serve®. Both are easy on fees, and they’re nearly identical in features.

But nearly two million fewer locations in the U.S. will accept American Express prepaid cards compared to Visa or Mastercard.

Bluebird by American Express not what you are looking for? Check out other options in our Best Prepaid Debit Cards list.

So, do the features and cost savings for Bluebird warrant less convenience? And if you’re going to choose American Express, does Bluebird beat Serve?

We’ll cover the features and fees so you can make an informed choice.

Features of the Bluebird Card

The Bluebird card offers several features that make it a viable replacement for a checking account.

Key Features

- Bill Pay. With Bluebird, you can pay bills for free, either online or through the Bluebird mobile app. For vendors that aren’t set up for electronic payment, they’ll send a check. The online portal allows you to set reminders for recurring bills.

- Bluebird Mobile App: The Bluebird app is available for iPhone and Android devices. You can use the app to deposit checks to your card or to find the nearest MoneyPass ATM.

- Free ATM Network: Bluebird offers free ATM transactions at MoneyPass ATMs. You can avoid ATM fees with most prepaid cards using a cash back option at retailers. But if you’re a frequent cash user, having a free ATM option can add extra convenience and savings.

- Family Accounts: You can get additional cards along with your primary card for free for other family members. Even your teens can get their own debit card attached to the primary account.

- SetAside Account: You can create a set aside account with the Bluebird card. It provides a way to stash money from the amount available for spending. It doesn’t pay interest like some other cards, but it’s a handy way to set a short-term savings target, like a vacation fund.

- Transfers between Bluebird Cards: You can send or receive money to or from any other Serve account at no charge.

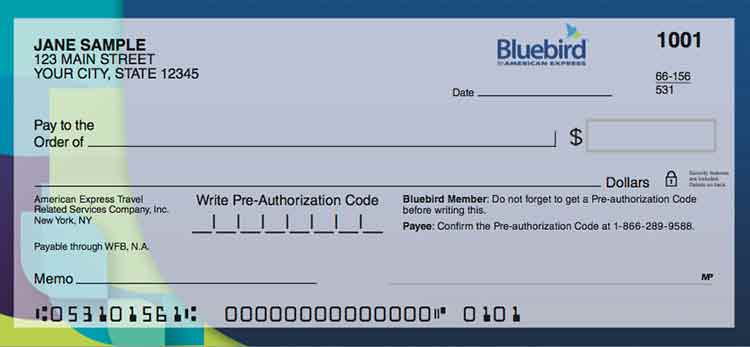

- Paper Checks. Bluebird is one of the few cards that allow you to get paper checks to write against your card balance. The checks cost $19.95 for 40. They work like checking account checks except you have to preauthorize the check before you write it. You can sign onto your Bluebird account and specify the amount of the check. You’ll receive a preauthorization code that you write on the face of the check.

Compared to Serve

The Serve card offers all of the same features as the Bluebird card except one. Serve doesn’t offer paper checks. It does, however, provide the same bill pay features as Bluebird that allows you to send paper checks. The difference is minimal. But if you need to have checks handy to write yourself, then this Bluebird feature will be an advantage over Serve.

Card Limits

The Bluebird card has the same limits as the Serve card. The maximum card balance, like Serve, is $100,000, far higher than any prepaid card.

The daily spending limit of $15,000 is also higher than most cards.

Fees

Like Serve, the Bluebird card has low fees. That, along with its list of features, put it on our list of the best prepaid debit cards. The Bluebird card, however, has one advantage over the Serve card on fees. Unlike Serve, Bluebird charges no monthly fee.

The monthly fee for the basic Serve card is a mere $1. And with direct deposit of $500 or more per month, the monthly fee is $0. Still, for those that won’t use direct deposit, Bluebird offers an advantage.

All other costs of the Bluebird card are the same as Serve.

ATM transactions are free for MoneyPass network ATMs. Withdrawals at out-of-network ATMs cost $2.50 plus the fee charged by the ATM owner.

Adding Money to Your Bluebird Card

You can add money to the Bluebird card in several ways.

Direct Deposit: You can set up direct deposit for paychecks or many government benefits checks without a fee.

Online Bank Transfer: If you have a bank account, you can transfer funds to the Serve card online for free.

Mobile Check Deposit: You can deposit checks using the Serve mobile app for free. Check deposits are processed through Ingo Money and take 10 days if using the free option.

Cash Reloads: You can load cash to your Bluebird card at the same retail locations as Serve. They include CVS, Walmart, Dollar General, Family Dollar, and most 7-11 locations. Cash loads cost $3.95 up to $500. However, Bluebird offers cash loads at Walmart registers at no charge.

The Serve card offers the same cash load options as Serve. But Bluebird offers free reloads at Walmart. Serve does offer a American Express Serve® that provides free reloads at all of the American Express reload locations, but it charges a higher $4.95 monthly fee.

Where to Get the Bluebird Card

You can get the Bluebird card at just one retail store–Walmart. The in-store purchase price is $5. You can get it online for free.

Summary

The Bluebird card has excellent features at a low cost. Its only downside is convenience. You’ll be able to use it at most retail locations and websites, but you’ll inevitably run into places that won’t take American Express.

So, if you’re looking for a prepaid card as a budgeting tool that supplements your checking account or credit card, then Bluebird is a great choice. If you want to use a prepaid card to replace a checking account, then Bluebird will only work if you’re prepared to use cash and put up with some inconvenience.

If you decide on an American Express, Bluebird is the better choice compared to Serve. But it’s close. Bluebird charges no monthly fee. You have to be a direct deposit user to get the monthly fee waived with Serve. Plus, Bluebird has one free cash reload option that Serve doesn’t have.

Best For: Prepaid card users that will use a prepaid card with a credit card or bank debit; those that make frequent ATM withdrawals.

Not So Good For: Prepaid card users who want broader acceptance by retailers.