GoHenry–a Prepaid Card with Teachable Moments for Kids

GoHenry isn’t just a teen prepaid card. It’s a financial education tool for parents to teach their kids about money management. Here’s how it works.

The GoHenry prepaid card modernizes kids’ money management for both parents and their children. At its core, GoHenry is a prepaid Mastercard. So, when it comes to spending, it works like any other Mastercard. But the GoHenry card is designed for teens and even younger children. Kids as young as 6 and up to 18 can use the GoHenry card.

But the primary benefit of the GoHenry card isn’t solving the problem of how kids spend money. It’s equipping parents with the tools to teach their children how to manage it.

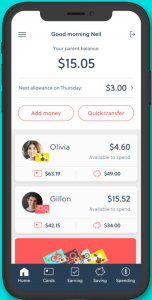

Parents set rules on how their children can use the card and how the card is funded. So, parents can automate payment of a weekly allowance and can even tie that payment to a chores list. Parents also determine whether or not their children can use their cards online, in stores, or at the ATM.

Most importantly, GoHenry provides transparency. Parents have a real-time view of their children’s spending and savings through GoHenry’s mobile app and online portal. So, parents can provide their kids with a measure of independence to make choices, but with parents’ oversight.

For parents with teens, the GoHenry card checks nearly all the boxes. And GoHenry’s simple fee structure, parental controls, and gorgeous mobile app put it on our best teen prepaid cards list.

Benefits for Parents

- Setting the Rules. Parents can determine how their kids use their GoHenry cards, and the rules can be set differently for each child’s card. So, parents can set age-appropriate restrictions, such as disallowing online purchases for younger children. Parents can set maximum spending amounts that can be per week, per purchase, or both.

- Easy to Use. What parent doesn’t want easier? GoHenry spares parents the trips to the ATM to pay cash allowances. Instead, you set an automated transfer to your child’s account each week. And rather than constantly remind your kids to do their chores, set a list through the mobile app that kids have to complete to earn that allowance.

- Teachable Independence. Children learn best when they have some independence to make their own decisions. GoHenry provides that independence and empowers parents to make the consequences of their children’s money choices clearly visible. Instead of the negotiations about whether your child can make a purchase, kids learn quickly that they can spend only what they have on their GoHenry card. For bigger purchases, goHenry equips kids with the ability to set aside money towards a savings goal. And attaching jobs to their allowance gives children a more direct sense of earning their money.

- Oversight. Some independence is good, but children need oversight. Parents have instant visibility into their child’s spending, and they can set text alerts to be notified whenever their child uses their card. They can even instantly turn a card off if needed.

- Safety. Funds on a goHenry card are FDIC insured, just like a bank account. And Mastercard’s zero liability policy protects against fraudulent purchases, theft, and loss.

- Free Trial. GoHenry comes with a 30-day free trial so parents can take it for a spin before paying anything.

GoHenry’s Benefits for Teens and Children

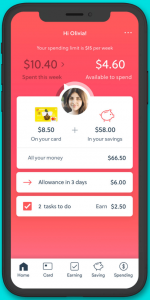

Spending. Children can use their goHenry card to spend their own money online or in stores, as long as it’s within the rules set by parents.

Spending. Children can use their goHenry card to spend their own money online or in stores, as long as it’s within the rules set by parents.- Mobile App/Online Portal. Teens and younger children can access their own account balance and transaction history using something they’re probably already used to–a mobile app. GoHenry’s app makes it easy, clearly showing the remaining spending balance on the card and how much is set aside for savings. It also shows kids their purchase history, creating some visibility on the choices they’ve made with their money.

- Savings Goals. GoHenry lets kids set aside money for larger purchases–like that game console. And it shows them the progress they’re making towards their goal.

- Earning. Kids can see when their next “payday” is scheduled, allowing them to plan accordingly.

Adding Money to the GoHenry Card

Parents fund their primary GoHenry account using a checking account debit card. You fund your children’s subaccounts through transfers from the primary account. You have the option to schedule automatic transfers to your children’s accounts or you can transfer money instantly through the mobile app or web portal.

Teens that hit working age can set up direct deposit with their employer to deposit paychecks directly to their card.

There is no way to add cash directly to a GoHenry card.

GoHenry Fees

The GoHenry card has a monthly fee of $3.99 per child account. The monthly fee is charged to the parent’s debit card used to fund their primary account.

GoHenry also charges an ATM fee of $1.50 per withdrawal, which is charged to the child’s subaccount. ATM withdrawals will also incur any fee charged by the ATM owner. Parents, however, can decide whether their children are permitted to use ATMs.

With the goHenry prepaid card, there are no purchase fees, no activation fee, and no “junk” fees that come with some prepaid cards.

GoHenry Card Limits

The maximum account balance for a parent’s GoHenry account is $6,000–certainly plenty for most parents looking for a way to handle money for children. The spending limit is generous at $2,500, but that’s all subject to parental control. The same with ATMs, but up to a maximum amount of $120 per day per card.

Final Word

Unlike cash and piggy banks, the GoHenry card provides teens and younger children with a view of money that looks more like how they’ll use money as adults. But it also provides the safety net of parental controls and oversight to point them in the right direction.