Mission Money Debit Card–A True Zero-Fee Prepaid Card

The Mission Money Debit Card provides a pretty attractive feature. It charges no fees. Nada. Nothing. No transaction fees, no monthly fees, no purchase fees, and no ATM fees.

So what’s the catch? No catch. There’s no credit check. You just need a name, social security number, and a pulse. Ok, there’s a short application, but just the basics.

Mission Money Debit Overview

There are several prepaid cards out there that have fees competitive with traditional bank accounts. And there are even cards that waive nearly all fees if you, say, use direct deposit or make a minimum number of purchases on the card.

The Mission Money card skips that and goes right to being free. And it has all the features most people would look for in a prepaid card. It’s Visa-branded, so you can use it anywhere (including abroad), and it has an easy-to-use app to track everything.

Did I mention it costs nothing?

Features

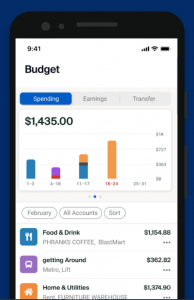

Mobile App: The Mission Money card comes with a mobile app for iPhone or Android devices. It allows you to track your transactions and spending by categories, locate an in-network ATM nearby, and transfer money.

Transfers to Your Card or From Your Card: Every prepaid card lets you transfer funds from a bank account to your prepaid card. But not all of them allow you to transfer money the other way. Mission Money does. If you want to take some money off the card, no problem. And no fee.

Bill Pay: Several prepaid cards offer bill pay, but Mission Money’s bill pay service is more like a traditional banking account. You can set up a vendor in bill pay for anyone you need to pay. And if the vendor can’t take electronic payments, Mission Money will send a check. No fees here either.

Digital Card: You can create a digital version of the card on the fly with a unique account number for added security. Creating a digital card provides an added level of protection when making online purchases. You’re not providing your actual card number.

Text Alerts: You can set alerts through the mobile app to get a text notification for transactions or low balances on your card.

Free ATM Transactions: Among prepaid cards, free ATMs have become a rare commodity. The Mission Money card has them. They not only charge zero for all ATM transactions, but they also offer a free ATM network that gets rid of the ATM surcharge. Over 55,000 in-network ATMs, which you can locate in the mobile app.

FDIC Insured: Although it’s typical among prepaid cards these days, it’s worth mentioning. All funds deposited to your Mission Money card get the same FDIC protection as a bank account.

Mission Money Debit Card Fees

None.

Ok, let me elaborate. Most prepaid cards come with a monthly fee, although there are a few exceptions. And free ATM transactions have become rare. But Mission Money charges neither.

You won’t see any less common fees either, like inactivity fees, purchase fees, or activation fees. Additionally, paper checks, bill pay, even replacement or secondary cards are all free. Pretty unheard of.

Limits on the Card

Like all prepaid cards, the Mission Money card has a balance limit–$10,000. That’s about average among prepaid cards. The balance limit is also the spending limit. While the card limits individual spending transactions to $7,000, the transaction and spending limits are well above most prepaid cards.

The per transaction and daily ATM limit are $250, which is on the low side. $500 is more typical.

Depositing Funds to the Card

You can fund your Mission Money account using direct deposit or ACH transfer from your bank account as with all prepaid cards.

If anything could be considered a catch to the Mission Money card, it’s this. There’s currently no way to deposit cash to the card. For some, notably those without bank accounts, that could be a show-stopper. But Mission Money does offer some alternatives to having a bank account–like PayPal, Venmo, and Apple Cash. You can fund the card from any of these sources. And Mission Money doesn’t charge a fee for any of these transfers.

The Bottom Line

Let’s not bury the lead. The Mission Money Debit Card charges no fees to get or use its card. That puts it squarely among the top choices among prepaid cards.

And it doesn’t sacrifice most features that prepaid card users are looking for. It even adds one that you won’t find with many prepaid cards–the ability to transfer money off the card.

The downside? There’s no cash load option, so a bank account (or Paypal, Venmo, or Apple Cash) is required. So, for those without a bank account, this card may not be a good fit.

Best For: Prepaid card users looking for a fee-free card with all the features you’ll need.

Not So Good For: Prepaid card users that don’t have a bank account.