Movo® Prepaid Visa Card–Bitcoin Meets Prepaid

The Movo Prepaid Visa highlights its bitcoin conversion feature. But even if you’re shy on bitcoin, this may be the prepaid card for you.

Movo is not your father’s prepaid card. You can’t get the card online or in stores. It speaks the language of cryptocurrency. And if you’re a Movo customer, you may not be carrying a card at all. That’s by design. Movo fashions its product more as an “e-wallet app” than a prepaid card.

Call it what you will. Even with its bitcoin exchanges and virtual card features, Movo is still solidly in the prepaid debit category. That’s not to say that the more innovative features won’t appeal to some. But for most people interested in a prepaid card, all of the basics of a prepaid card are still there. And they can come at a pretty low price.

Movo® Prepaid Visa Card not what you are looking for? Check out other options in our Best Prepaid Debit Cards list.

How Does Movo Work?

It’s all about the Movo Cash app. Unlike most prepaid cards, you can’t get a Movo card through its website. Instead, you download the cash app (for free) and sign up for a Movo account through the app. Unlike other prepaid cards, you don’t have to wait for a physical card to start using your account. Once you sign up for a Movo account and fund at least $20, you can use funds in the account for spending right away.

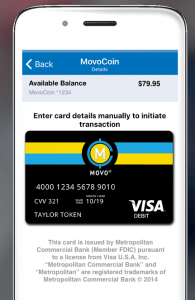

Digital Wallets and Virtual Cards

To spend at brick-and-mortar retailers, you have the option of connecting your Movo account to any of the big three digital wallets–Apple Pay, Google Pay, or Samsung Pay. To spend online, you can use your Movo digital card, just like a physical card. You can also generate a single-use virtual card instantly within the app. A single-use virtual card provides a way to complete a debit card purchase without using your true debit card number. After the purchase, it’s unusable so there’s no way that your primary card can be compromised.

To spend at brick-and-mortar retailers, you have the option of connecting your Movo account to any of the big three digital wallets–Apple Pay, Google Pay, or Samsung Pay. To spend online, you can use your Movo digital card, just like a physical card. You can also generate a single-use virtual card instantly within the app. A single-use virtual card provides a way to complete a debit card purchase without using your true debit card number. After the purchase, it’s unusable so there’s no way that your primary card can be compromised.

Getting a “Real” Card

While Movo emphasizes the digital card, you still have the option to get a physical card as well. Oddly, you can’t order a physical card through the Movo cash app. You have to send an email to [email protected] with the subject line “Please send me a card.”

Why get a physical card? Other than having a piece of plastic that you might be more use to, there are a couple of reasons why you’ll likely need a physical card. First, you can’t use digital cards to get cash at ATMs. For many prepaid card users, cash is still alive and well–with the average millennial prepaid card user making 2-3 ATM trips per month, according to our 2018 survey.

Second, digital wallets still aren’t accepted everywhere that physical cards are. According to Apple, 65% of U.S. retail locations accepted Apply Pay earlier this year. But acceptance is growing–Apple expects the number to hit 70% by the end of 2019.

What’s With the Bitcoin Stuff?

And then there’s cryptocurrency. Movo is the only prepaid card that can use bitcoin or bitcoin cash (BCH) for transfers or purchases. While it’s a unique feature to be sure, it raises the question as to who exactly would want it. I’ll admit, my personal interest in cryptocurrency is on the low side. So, I may be speaking totally out of my blockchain when I say that the bitcoin feature of Movo is perhaps more of a novelty than a core feature.

But for those that intend to use it, it comes with a fee–one of the few things that do with the Movo card. Transfers cost 2% of the transferred amount plus a flat fee of $2.

Other Features of the Movo Prepaid Visa

Like most prepaid cards, Movo offers standard features like direct deposit and the ability to fund your Movo account by transfers from a bank account. In addition, your Movo card comes with the following:

Mobile App: That’s Movo’s focus. In the app, you can setup bank transfers, fund the account from PayPal or Square Cash, pay bills, and see your transaction history.

Bill Pay: You can pay any of 8,000 vendors through Movo’s bill pay system, including setting up recurring payments. For vendors that only take paper checks though, you’ll have to find another payment option. Movo doesn’t send paper checks.

Near-instant transfers to others: Movo offers its own P2P payment system that allows you to send money through the mobile app to anyone using a phone number or email address. The recipient has to receive the money in their own Movo account, however. So, if you send money to someone without a Movo account, they’ll be prompted to download the Movo app. If they don’t in three days, Movo returns your money.

Bitcoin: Yeah, bitcoin. You can use a bitcoin or bitcoin cash wallet to make payments or make transfers through Movo. For transfers, the recipient doesn’t need to use bitcoin. The cryptocurrency will be converted to dollars. And who knows, maybe we’ll all be using bitcoin soon.

Movo Fees

To me, the Movo fees are one of its best features. It costs nothing to get the app or a digital or physical card. And there’s no monthly fee and no transaction fees. Bill pay and transfers to other Movo apps are also gratis. There’s not even a fee to get a balance refund check should you decide Movo isn’t for you. Pretty nice.

Movo doesn’t have free ATM withdrawals, however. Movo charges $2 per withdrawal (in addition to any fee charged by the ATM owner/operator).

Transfers in bitcoin also cost 2% of the transferred amount plus $2.

Like most prepaid cards, you can load cash on your Movo card for free through bank or PayPal transfers or by direct deposit of your paycheck. Movo also offers cash loads through Green Dot MoneyPak, Green Dot Reload@theRegister, or Visa ReadyLink. Movo doesn’t charge a fee to load cash on the prepaid card using those services, but the retailers that offer them will. The fee ranges from $3.74 – $5.95 per cash load.

While Movo doesn’t charge a monthly fee, that’s only as long as you’re using the card. If it’s inactive for 90 days, a fee of $4.95 applies.

Bottom Line

If you’re crazy into bitcoin, Movo’s definitely your prepaid card.

Even if you’re not, but just want a basic prepaid card without all the fees, Movo’s still a good choice. Although it lacks free ATM withdrawals and savings or budgeting features, if you go easy on the ATM trips and have other ways to stash your savings, then you can use this card on the cheap.

Best For: Bitcoin fans or those just looking to save on prepaid card monthly fees

Not So Good For: Those looking for free ATM access or savings and budgeting features.