UNLIMITED by Green Dot Review–High-Interest Savings and Cash Back

The Unlimited Cash Back Account by Green Dot is a bank account that feels like a prepaid card. But it adds new benefits that its prepaid card never had.

The Unlimited Cash Back Account by Green Dot isn’t exactly a prepaid card. But it’s pretty hard to tell the difference. The new account, launched in July 2019, is Green Dot’s latest offering that significantly expands the benefits of Green Dot’s prepaid cards that the Unlimited account looks to replace. And it adds some new features to appeal to those that still turn to traditional bank accounts.

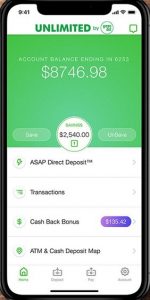

The Unlimited Cash Back Account emphasizes two big selling points–cash back on purchases and high-interest savings. Both features set it apart from most prepaid cards and typical bank accounts. Its cash back rewards eclipse virtually every debit card out there. It offers 2% cash back rewards on all in-app or online purchases. And as the name suggests, it’s unlimited; there’s no maximum to the rewards that you can earn. However, only online and in-app purchases qualify, not spending at brick and mortar stores. So, Walmart.com qualifies; Walmart stores don’t.

Unlimited Cash Back Bank Account by Green Dot not what you are looking for? Check out other options in our Best Prepaid Debit Cards list.

The savings feature also sets the Unlimited Cash Back Account apart from the pack. It offers a 2% APY on savings balances up to $10,000. While a handful of prepaid cards offer high-interest savings, Green Dot’s Unlimited Account has a higher qualifying balance than most. And the rate exceeds that offered by the vast majority of traditional and online bank savings.

With the new account, Green Dot also brings back a highly-missed feature that it dropped from its prepaid cards–free in-network ATM withdrawals.

Here are the details.

Features of the Unlimited Cash Back Account

Although technically not a prepaid card, Green Dot’s Unlimited card works pretty much the same as one. There are no Green Dot Bank branches, so all you’re interactions with the account are through the Unlimited debit card and a mobile app–just like a prepaid card. Also like a prepaid card, there are no overdraft fees that you’ll find with traditional bank accounts.

Here’s how its other features stack up to prepaid cards.

Savings Account. The Unlimited Account provides an automatic savings account along with your primary spending account. You can transfer money from the spending account to savings instantly through the app with no fees. The savings account pays 2%* APR–well over the typical bank account savings rate. It’s lower than the few prepaid cards that offer high-interest savings, like Netspend and PayPal (5%) and Mango (6%). But the Unlimited savings account pays interest on a much higher balance of $10,000 compared to the other cards ($1,000 for Netspend and PayPal and $5,000 for Mango).

Savings Account. The Unlimited Account provides an automatic savings account along with your primary spending account. You can transfer money from the spending account to savings instantly through the app with no fees. The savings account pays 2%* APR–well over the typical bank account savings rate. It’s lower than the few prepaid cards that offer high-interest savings, like Netspend and PayPal (5%) and Mango (6%). But the Unlimited savings account pays interest on a much higher balance of $10,000 compared to the other cards ($1,000 for Netspend and PayPal and $5,000 for Mango).

- *2% Annual Percentage Yield as of 6/2/20 on savings up to $10K, may change anytime.

- Visit GreenDot.com for terms and conditions.

Cash Back Rewards. The Unlimited Account pays 2% cash back for all in-app and online purchases. Although purchases at brick-and-mortar retailers don’t qualify, the cash back rewards have no limit on the amount you can earn. Other cash back cards, like Walmart MoneyCard and Green Dot’s Cash Back Prepaid Card, cap the maximum rewards at $75 (MoneyCard) and $100 (Green Dot Prepaid).

Bill pay: While many prepaid cards allow for bill pay, many charge a fee to mail a check. The Unlimited Cash Back Account offers free bill pay for all vendors, including those that require paper checks.

Free ATMs: While there are a few prepaid cards that offer free ATM withdrawals, most have gone the way of the dodo. The Unlimited Account brings back this benefit. You can find free ATM locations using the Green Dot app.

Limits of the Unlimited Cash Back Account

Because the Unlimited Account is not a true prepaid card, it doesn’t have a maximum card limit. However, it has other limits that you would find with prepaid cards.

Daily spending, for example, is limited to $10,000–much higher than the average prepaid card. ATM withdrawals are limited to $500 per day. That’s pretty typical for bank accounts and prepaid cards.

Cash deposits to the account are limited to $3,000 per day. While that’s common for prepaid cards, it’s not typical for traditional bank accounts.

Green Dot’s Fees for the Unlimited Account

As you would expect with most accounts, there are no fees for making purchases with the Unlimited debit card. There is a monthly fee, however, of $7.95. Most bank accounts and prepaid cards charge a monthly fee as well, although the Unlimited Account fee is higher than the average prepaid card monthly fee. But the Green Dot Unlimited Account offers a pretty easy way to avoid it altogether. Spend at least a $1,000 in the month, and the fee is waived.

The Unlimited Cash Back Account doesn’t charge any fee for direct deposit, mobile check deposits, or bill pay. It also offers free in-network ATM withdrawals. Out-of-network ATM withdrawals, however, cost $3.00.

Paper checks also cost extra–$5.95 for 12. That’s pricey by checking account standards. But, with its bill pay features, the need for checks is minimal.

Adding Money to the Unlimited Cash Back Account

Like most prepaid cards and checking accounts, direct deposit to Green Dot’s Unlimited Account is free. You can also transfer funds from other bank accounts without charge.

Adding cash, though, works like Green Dot’s prepaid cards. You can use Green Dot’s MoneyPak or Reload@TheRegister for a fee of $4.95-$5.95 per deposit. Those services are available at retailers like Walmart, Dollar General, and 7-Eleven. Green Dot also offers a way to deposit cash for free at certain retailers, but so far, Green Dot has been sketchy on the details of which retailers are participating.

Is It a Prepaid Card or a Bank Account?

The Unlimited Cash Back Account has more similarities to prepaid cards than traditional bank accounts. Green Dot Bank has no branches, so you’ll be dealing with your account through a mobile app and a debit card. Cash deposits to the Unlimited Account look exactly like cash loads to prepaid cards. They’re through services like Reload@TheRegister at retailers rather than through branch tellers or ATMs. Both prepaid cards and the Unlimited Cash Back Account are FDIC insured. No difference there. And the Unlimited Account, unlike most checking accounts, has no overdraft fees. Transactions (checks or debit purchases) are just rejected if they would exceed the available balance. Again, just like prepaid cards.

Still, the Unlimited Cash Back Account is technically a bank account. Prepaid cards generally hold the card balances of its cardholders in an aggregate bank account–that is, a single account with many cardholders’ card balances. The funds in those aggregate accounts are, of course, tracked to the individual cardholder, but there’s no separate account for each cardholder. In that sense, the Unlimited Account is different. Account-holders have their own account with Green Dot Bank.

So, while the Unlimited Cash Back Account is a bank account, an account holder would see virtually no difference compared to using a prepaid card.

Opening an account is also closer to a prepaid card than a traditional checking account. You provide identifying information like name, address, and social security number–just like prepaid cards. You can find that application by clicking here.

Although the account is free to open online, you’ll see starter kits along with a debit card at the same retailers where prepaid cards are sold–like Walmart and Walgreens.

How Does the Unlimited Account Compare to Green Dot’s Prepaid Cards?

The Unlimited Account offers distinct advantages over Green Dot’s two remaining prepaid cards–the Green Dot Prepaid Prepaid Visa and the Green Dot Cash Back Prepaid Card. Unlimited offers unlimited cash back on qualifying purchases. The Cash Back Prepaid Card caps rewards at $100; the Prepaid Visa doesn’t offer them at all. Neither of the prepaid cards offers interest-bearing savings. The Unlimited Account does.

It’s also cheaper. While the monthly fee for the Unlimited Account is the same as the Prepaid Visa–both charge $7.95 but offer an easy way to waive the fee–the Unlimited Account is the only one that offers free ATM withdrawals and a free way to load cash. As far as using the Unlimited debit card, even those that have preferred using prepaid cards over bank accounts are unlikely to notice a difference.

The comparison, however, may be academic. Green Dot appears to be shifting away from its prepaid cards entirely. Neither the Prepaid Visa nor the Cash Back Prepaid Card is available online anymore. While they’re still available for purchase at retailers, neither looks long for this world. Expect Green Dot to pull the cards altogether within a year.

The Bottom Line

With its cash back rewards and its high-interest savings account, the Unlimited Cash Back Account by Green Dot offers benefits not found in most prepaid cards or bank accounts. And it presents an opportunity for lower fees compared to Green Dot’s prepaid cards.

For those that expect to use the debit card for more than $1,000 per month in spending, it’s a solid choice. For those that won’t, there are prepaid cards with cheaper fees.

Best For: Prepaid card users that spend at least $1,000 per month using the debit card; those looking for online bill pay; and those that make frequent ATM withdrawals.

Not So Good For: Prepaid card users that spend less than $1,000 a month; those that still use checks regularly.