The Visa Buxx card was the first teen prepaid card, but it’s hard to come by these days. What’s left and what are the alternatives?

Visa Buxx was the first of its kind. Launched in 2000, it was the first prepaid card made for just for teens. Visa believed there was a market for a prepaid card as a way to provide teens with the spending flexibility of plastic while still giving parents control.

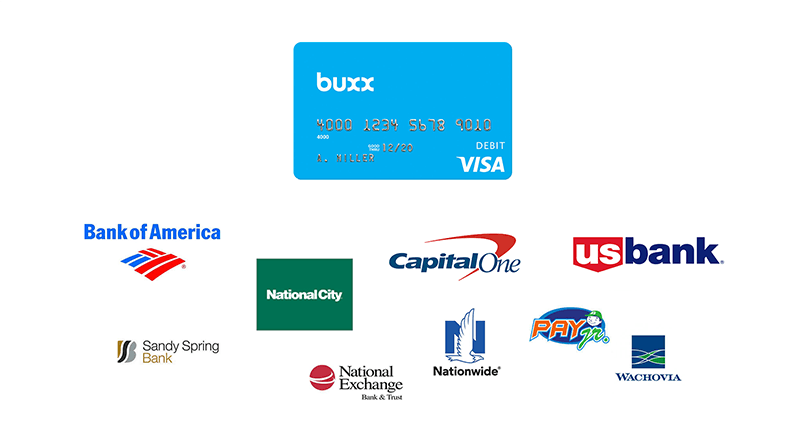

And banks agreed. Early on, this card was offered by a number of the largest banks, such as Capital One, U.S. Bank, National City, and others.

But after 18 years, most issuers have dropped their Visa Buxx cards. In fact, the number of issuers has dwindled to two–TD Bank and Navy Federal Credit Union.

So, what’s left of Visa Buxx and what are the alternatives for teen prepaid cards?

What is it?

Like all Visa branded cards, the Visa Buxx card is issued by banks or other financial services companies through a license from Visa. So, Visa sets the terms under which banks can issue the cards, but the issuers determine the fees they charge.

Visa’s rules require, for instance, that Visa Buxx cards cannot be issued to minors less than 13 years old and that the card contains certain parental controls, such as spending or cash access limits.1 Visa’s rules also require that Visa Buxx issuers provide online account management and parental notifications of transactions and balances.

However, Visa allows the issuing banks to set the fees and determine most of the features for the cards that they issue using the Visa Buxx brand. So, the fees and many features can (and do) differ from one bank to the next.

History of the Visa Buxx Card

Visa created the Visa Buxx card in 2000. U.S. Bank was its first issuer, but others quickly followed. By 2001, Bank of America, Capital One, National City Bank, and Wachovia Bank, along with U.S. Bank, issued Visa Buxx cards.

The Buxx card was later offered by non-bank financial services companies, like PAYjr in 2007. In 2008, Bancorp Bank, the largest prepaid card issuer, issued the Visa Buxx card for PAYjr and later CardLab, PAYjr’s successor.2

These cards differed significantly among issuers in both fees and features. Buxx card issuers charged activation fees ranging from $4 to $12 and monthly fees from $0 to $5.3, 4, 5, 6 Other fees, like ATM charges, also varied.

For example, the U.S. Bank and Nationwide Bank Visa Buxx cards charged no monthly fee or transaction fees. U.S. Bank offered free ATM withdrawals at U.S. Bank ATMs. But it charged a steep $10 initial activation fee and a $2.50 fee for each reload to the card if from non-U.S. Bank account.

The PAYjr Buxx card relied on more extensive features to distinguish itself from the bank cards. The card offered online tools for parents to tie allowance to chores, and it offered customizable cards to appeal to teens. But the PAYjr Buxx card charged for the extras. With an activation fee of $9.95, a monthly fee of $4.95 and a custom card fee of $10, it was among the more expensive of the Buxx cards.

Farewell, Visa Buxx — Almost

Although issuers of the card came and went, by 2015, most issuers had dropped the Buxx card.

By 2015, Bancorp Bank, CardLab’s issuer, stopped distributing Buxx cards altogether, and pulled the plug for existing cardholders in 2017.

U.S. Bank, the first Visa Buxx issuer, closed all of its Buxx accounts at the end of 2015.7

Nationwide Bank dropped the Buxx card in 2017, leaving only the Navy Federal and TD Bank cards.

One of the founders of both PAYjr cited the insufficient size of the teen prepaid card market as a key reason for discontinuing their Visa Buxx card. While its successor, CardLab still distributed the Buxx card for a few more years, CardLab’s focus shifted primarily to gift cards.

For those still interested in this card, those are the only remaining options. And both financial institutions offer the Visa Buxx card only to existing account holders.

For those that have an account, the Navy Federal Buxx card is cheap. There is no activation fee, monthly fee or transaction fees. The card also offers free ATM withdrawals at Navy Federal ATMs and other ATMs in its network. Out-of-network ATM transactions are $1.00 plus the ATM owner’s surcharge.

The TD Bank Visa Buxx, called TD Go Reloadable Prepaid Card, charges an initial $4.95 activation fee but no monthly or transaction fees. It also offers free ATM withdrawals at TD Bank ATMs but charges $3.00 for other ATMs. The TD Go card also charges for reloading the card–$1.00 per transaction.

Navy Federal Credit Union serves only military personnel and other Department of Defense employees and veterans. And TD Bank is limited to a 13 state region–mostly East Coast.

Alternatives to the Visa Buxx Card and the Future of Teen Cards

With the Visa Buxx card offered by only two banks limited to existing account holders, the Visa Buxx card is all but gone.

So is there a market for teen prepaid cards?

FamZoo would say yes. While the FamZoo Prepaid Card, like Visa Buxx, is offered to teens, it takes more of a family-based and money management education approach to its offering.

The FamZoo prepaid Mastercard offers a host of features for parents that not only allows parents to monitor their teens’ spending, but also enables parents to encourage good financial habits. Habits like savings. FamZoo provides a way to match amounts their teens save or even pay interest.

And FamZoo’s not alone. Current Prepaid Visa Card and Greenlight both just launched prepaid cards aimed at teens last year. And GoHenry Prepaid Card, while in the U.K. for a few years, just brought their card to the U.S. The cards offer web-based and mobile app financial management tools for parents with teens as complements to their cards. For instance, the cards provide parents with controls to cap or even prohibit spending at designated locations. Greenlight and goHenry, like FamZoo, carry the Mastercard brand. But Current, interestingly, is a Visa-branded card, just not under the Visa Buxx program.

Perhaps these cards see a broader market among parents looking to better use of technology to educate their teens on money management and drive good behavior, as well as the oversight. Issuers of the Buxx card provided the oversight, but most provided little else.

Or perhaps the market itself has simply expanded since Visa Buxx was launched. At its 2000 launch, online spending was non-existent. Now, it’s commonplace, even among teens. And online spending means using plastic.

Either way, what’s clear is that while the Visa Buxx card has waned, the teen prepaid card isn’t going away anytime soon.