Emburse–Prepaid Cards Meet Business Expense Management

If you’re a business owner juggling employee expense reimbursement, the Emburse card might just simplify your life.

Emburse is a pre-funded credit card for business. It allows business owners to issue physical or virtual cards to employees or contractors to make necessary business purchases needed to do their jobs. As a “pre-funded” credit card, business owners deposit funds to the card in advance to fund business expenses rather than borrowing, so no credit is required for approval.

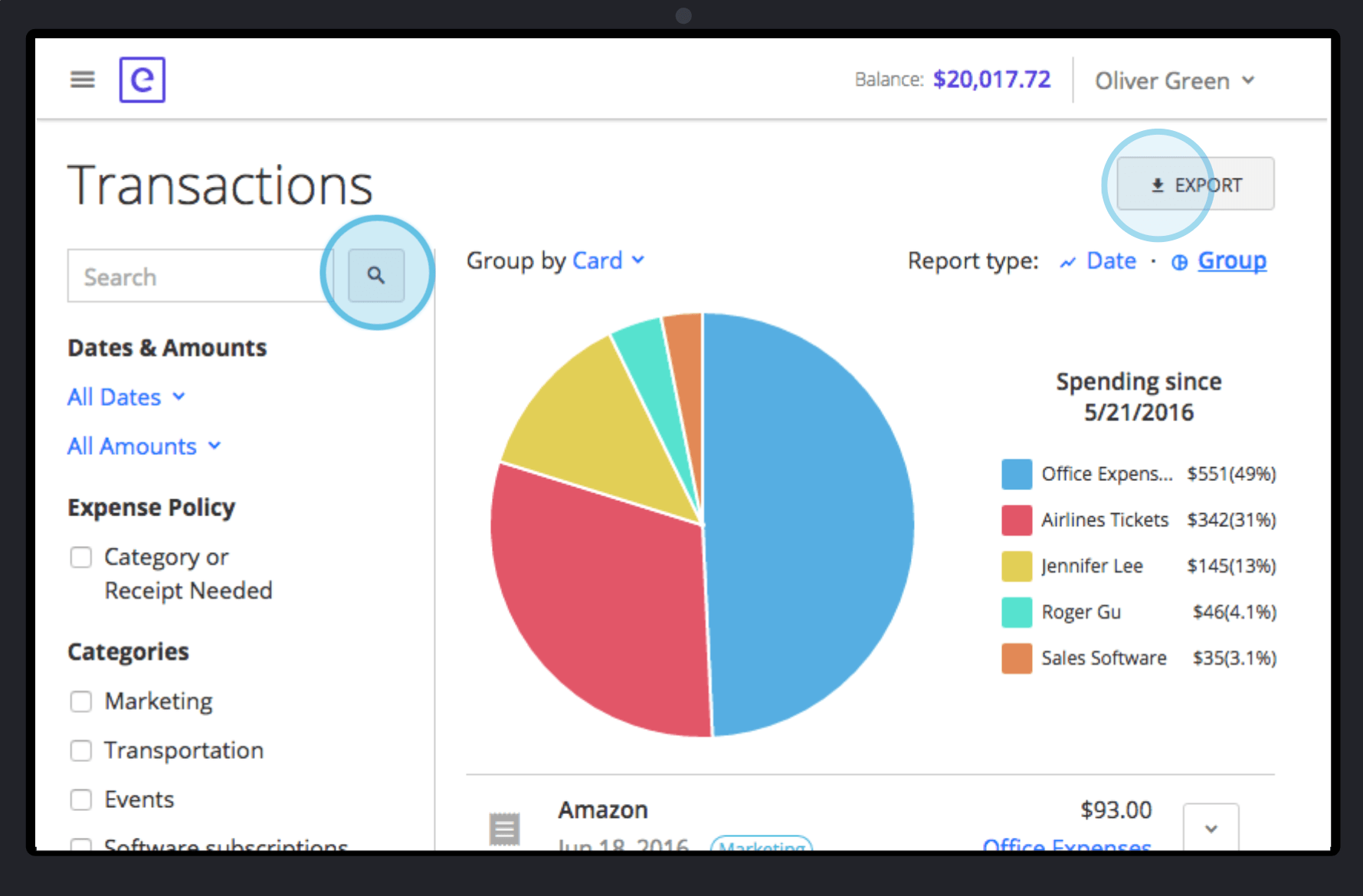

But it’s the administrative controls and accounting integration that simplifies a business owner’s life.

Control Employee Expenses

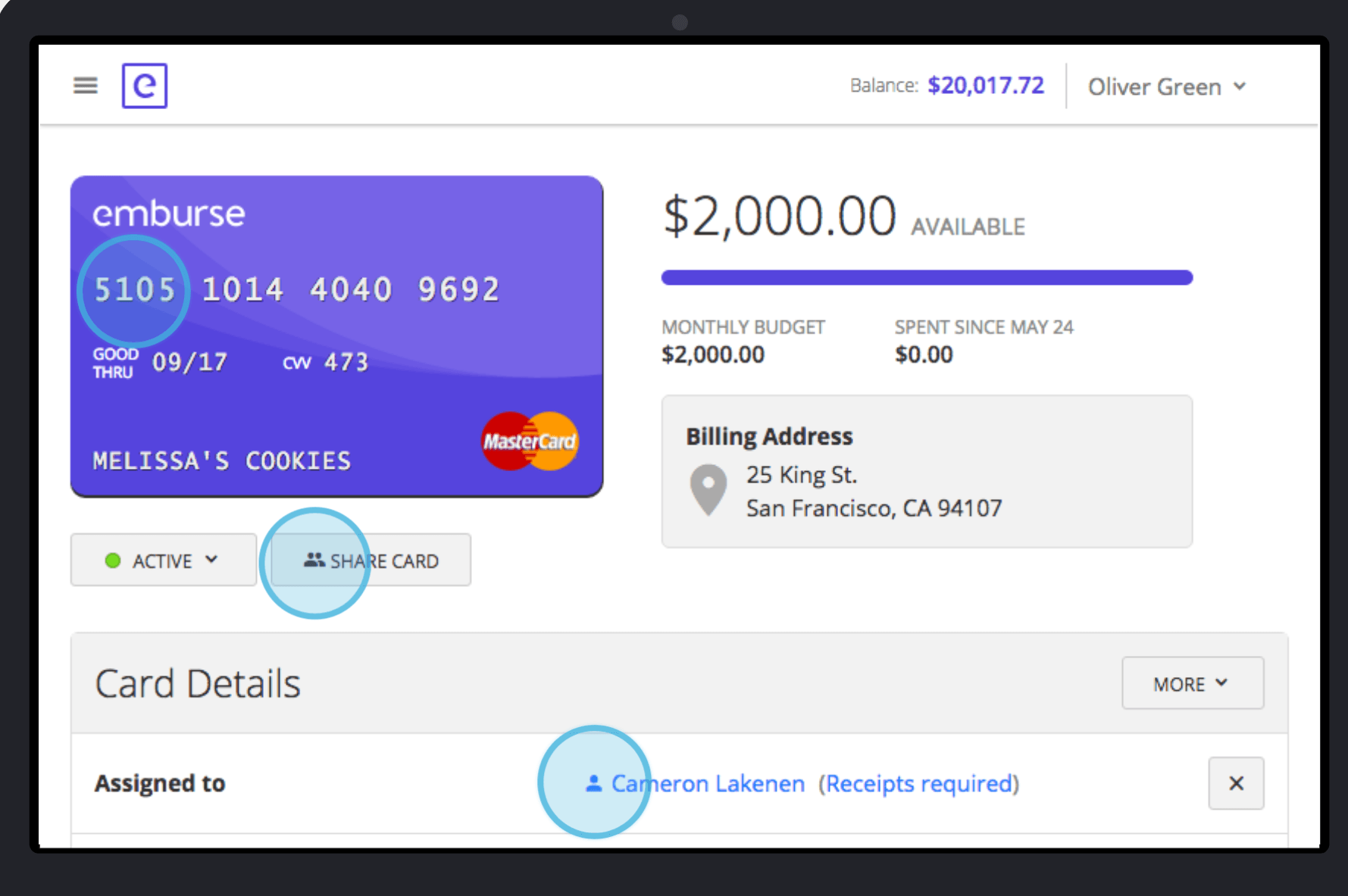

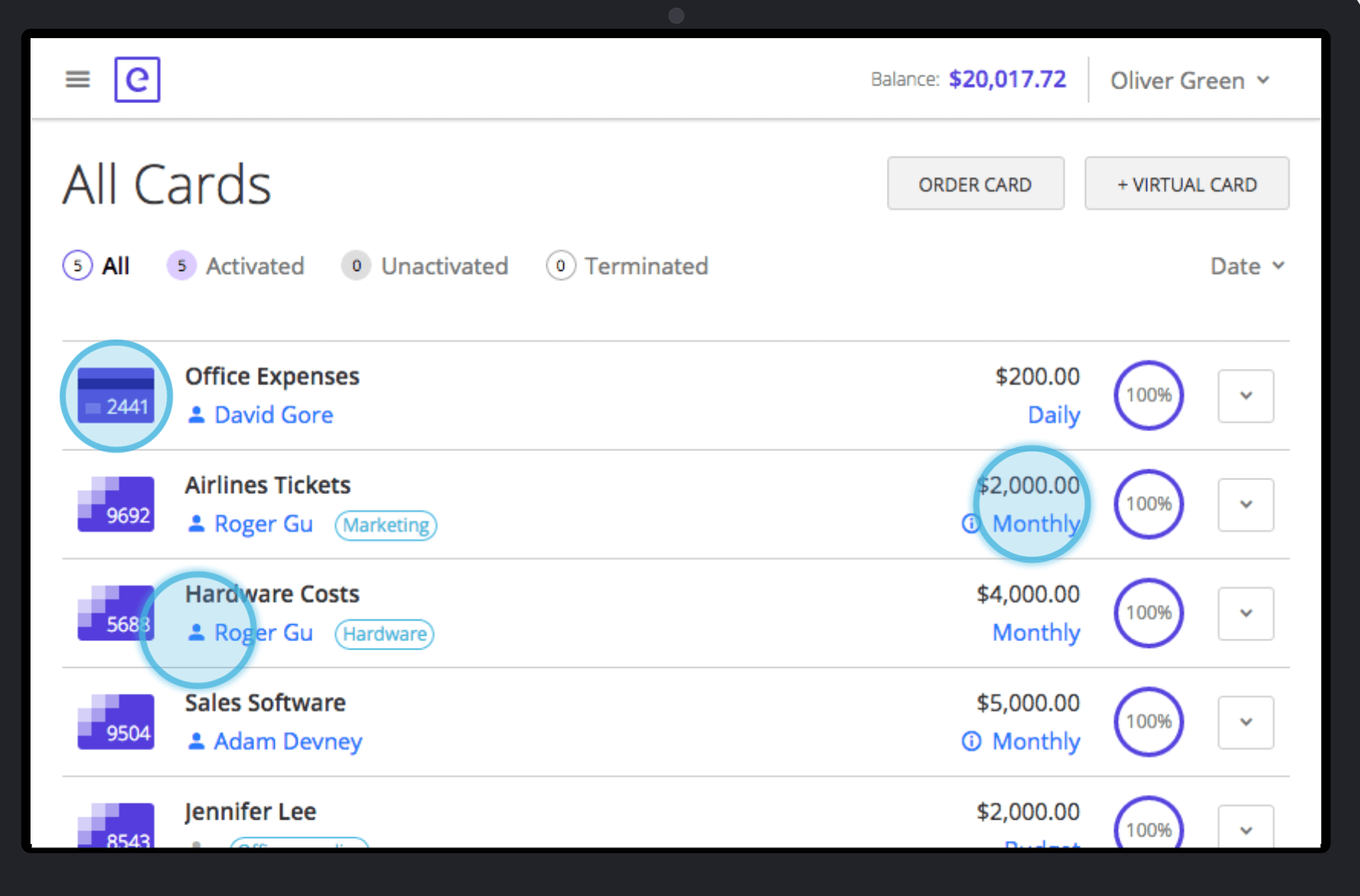

Emburse allows business owners to set limits on individual cards or expense categories. Owners or administrators can use the dashboard to assign a card to an employee or turn it off immediately.

Business owners can also set categories and limits on spending. For instance, you can allow a salesperson to spend only for travel expenses while allowing a technician to make purchases only at your parts supplier.

Set Department Budgets

You can use Emburse to set budgets that are shared among your employees. So, if you have capped advertising or promotional expenses, you can allocate that amount to be used by your sales or marketing team and establish accountability without the need to track to oversee every expenditure.

Capture Receipts

Emburse allows employees to capture receipts on their smartphone with the Emburse mobile app. That way, owners and their employees eliminate the hassle of tracking down those receipts after-the-fact.

Integrate Accounting

Emburse integrates with QuickBooks Online, Expensify, Netsuite, and Xero so there’s no need to manually enter data into your accounting system.

Cost and Limits of the Emburse Card

The Emburse card charges a simple monthly fee. It starts at $50 per month for up to 10 employees. For businesses with more than 10 employees or contractors, the cost is $7 per user per month.

The only other potential fee is a 3% foreign exchange fee for purchases made outside the U.S.

The card offers a 60-day trial, but there is no free option for smaller companies.

Emburse limits spending on all cards associated with the same business account to $25,000 per day.

Compared to Other Business Prepaid Cards

With its powerful employee expense management tools, Emburse makes our list of best business prepaid cards. While Emburse is actually a credit card, because it’s pre-funded, there’s little difference. It’s still funded in advance and cardholders are limited to the amount funded.

However, the Bento for Business, another on our list of the best, has comparable tools and is 40% less expensive than Emburse. It runs $29 per month for up to 10 cards. If you’re just starting out, you might check Bento’s free option, which allows for 2 cards.