A simple and free way to load cash onto a prepaid debit card is to use a bank transfer. You can transfer money online, and it takes just a day or two for the money to become available. In this article, we walk through how to transfer money from a bank account to a prepaid debit card.

One of the easiest ways to load money on a prepaid debit card is through an online transfer from a bank account. Bank transfers are free with virtually all prepaid cards, and the transfer can be completed online. There are, however, a few steps to take, and setting up the process can take a few days.

In this guide, we’ll walk through step-by-step how to transfer money from a bank account to a prepaid debit card. We’ll use the Netspend® Visa® Prepaid Card as our example, although the process is similar for all prepaid cards.

Step One: Get the Account Number and Routing Number

The first step is to get the bank account number and routing number associated with your prepaid card. Each prepaid card has an issuing bank that’s usually different from the card issuer.

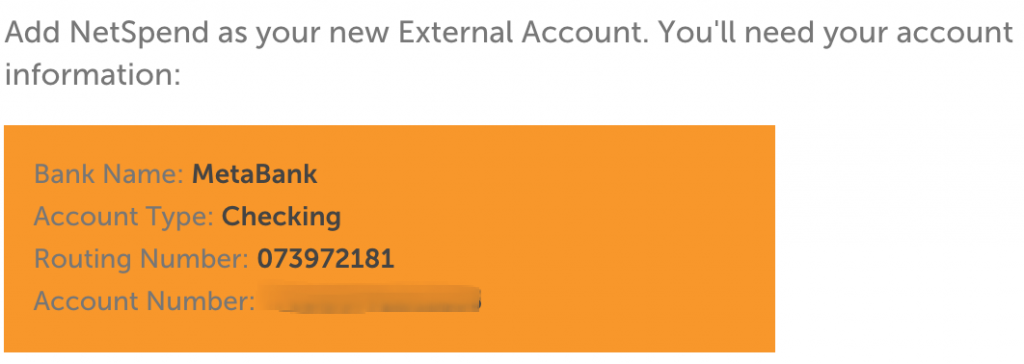

For example, the issuing bank for the Netspend® Visa® Prepaid Card is MetaBank, Member FDIC. The account number is a unique number that identifies your prepaid card, and it’s different from the number listed on the face of the prepaid card. The routing number identifies the bank that issued your prepaid card.

It’s easy to get this information for your prepaid card. Using Netspend as an example, simply log into your Netspend account and select the button or link to add money or transfer money. The issuing bank, account number, and routing number for your card will be listed under the option for adding money from a bank account.

Step Two: Add Your Prepaid Card to Your Bank Account

To transfer money from your bank account to any other account, you have to set up an external account through your bank. While the process varies somewhat from bank to bank, the basic steps are the same.

Log in to your bank account and navigate to where you can transfer money. Your bank should have a place where you can set up an external account. Here you can use the bank, account number, and routing number of your prepaid card to create an external account. If you run into problems, call your bank and they should be able to walk you through the process.

Step Three: Test Deposits

Before you can transfer money to your prepaid card (or any new account, for that matter), your bank will likely require verification of two small test deposits to the account. Once the deposits are reflected in your account, you log into your bank account and enter the amount of the test deposits.

This verifies that the external account has been set up correctly and that the transfers are being received by your prepaid card account. Once this verification is complete, you should be able to transfer money from your bank to your prepaid card.

Step Four: Transfer Money

Once your prepaid card is setup with your bank, transferring money is simple. Go to the transfer page on your bank’s website, and select the amount you want to transfer, the account to transfer the money from, and your prepaid card account as the account to transfer money to.

Transfers generally take at least one business day, so it’s important to note that the money will not be available on your prepaid card immediately.

Want to find a better prepaid card? Check out our recommendations for some of the best prepaid debit cards.