P2P apps like Venmo and Cash App are everywhere. But which ones can you use with prepaid cards? Here are the most popular options and one just for prepaid card users. You’re out to dinner with friends, and the check arrives. If you reach for your phone to chip in, you’re in good company. 82.5 million Americans will look to one of the money sharing (or “P2P”) apps, like Venmo or Square’s Cash App, to cover the check or pay their babysitter this year, according to NASDAQ.

[adrotate group=”6″]

P2P is shorthand for “peer-to-peer.” While P2P apps have differences, they all provide a way for individuals to make electronic payments to friends or family, usually using a mobile app. Users add a bank account, credit card, or debit card to their P2P app. When they use the app to pay their buddy for half the pizza, the app charges their linked account.

If you’re a prepaid card user, however, you may still have to “get the next one.” While the P2P apps are racing to capture a larger slice of the growing P2P pie, only two of them are accepting prepaid cards.

Which P2P Apps Take Prepaid Cards?

Here are the 4 most popular options and how (or whether) they work with prepaid cards.

PayPal

Well before P2P became an acronym, PayPal provided the first peer-to-peer payment alternative in the late 90s. Until then, the choices were cash or (gasp) checks.

With PayPal, you can send money to a friend or relative that also has a PayPal account. You can use your PayPal balance or a linked account to make the payment. A linked account can be a bank account, a credit card, a standard debit card, or a prepaid debit card.

If you use a linked prepaid card, you can send money to anyone with an email address. The transfer will take just a few minutes, but you’ll be charged a fee. That’s true for any linked credit or regular debit card. The fee is 2.9% of the amount transferred plus $.30. So, if you pay your friend $10 for your part of the check, you’ll see a charge on your card for the $10.59.

Can you use prepaid cards with PayPal?

Yes, for PayPal’s standard fee of 2.9% plus $.30.

Other P2P Payment Options with PayPal

If you use your PayPal balance, the transfer just takes a few minutes and is free. If you use a bank account linked to PayPal, it’s also free. But it will take 1-3 days for the recipient to get the money.

Transfers Out of PayPal

If you receive a payment through PayPal, it’ll go into your PayPal account. You can transfer the money out of your PayPal account to your prepaid card for free. It works just like transferring money from a bank account to your prepaid card. But you’ll need to set up your prepaid card as a bank account in your PayPal account and provide the routing and account number.

Just like transfers from PayPal to a bank account, it takes 1-3 days to get the money. The exception is the PayPal Prepaid Mastercard®. Transfers from PayPal to the PayPal Prepaid Card are instant.

Venmo

Venmo has become one of the most popular P2P apps, adding a social component to its mobile-only money sharing app. The app lets users send messages and, depending on your settings, shows when you make a payment through the app. A feature that some find community-building and others find a little, well, creepy.

Venmo (now owned by PayPal) is the only free option among the P2P apps that take prepaid debit cards. With Venmo, you can add your prepaid debit card as a linked account, and Venmo will charge your prepaid when you pay your friend–no fee added. Your friend is notified immediately when you make the payment, but like PayPal, it’ll take 1-3 days for the funds to hit your friend’s Venmo account.

Recipients have to have a Venmo account to receive payments, but setting up the account is free and fast.

Can you use prepaid cards with Venmo?

Yes. No Fees

Other P2P Payment Options for Venmo: You can fund Venmo payments using a bank account or standard debit card. They’re also free and take 1-3 days to complete, the same as prepaid cards. Like with PayPal, you can use your Venmo balance to make instant payments. Credit cards are the only payment source that comes with a fee–3% of the amount transferred.

Transfers out of Venmo: Transfers out of Venmo are more limited. Originally, you could only transfer your Venmo balance to a bank account through a standard ACH transfer, which takes 1-3 days.

But in 2018, Venmo launched “instant transfers.” Instant transfers allow Venmo users to transfer funds from their balance in 30 minutes using a debit card. However, only “eligible debit cards” qualify for instant transfers. How do you know if your debit card qualifies? Unfortunately, there’s no list. You have to add the card to Venmo. If the card is greyed out under transfers, it doesn’t qualify. If it’s not greyed out, it does. Instant transfers cost 1% of the payment amount with a minimum of $.25.

Cash App

Cash App (formerly, Square Cash) was created by credit card processor, Square. It works like Venmo in that you can use either your balance in Cash App or an external account to make payments.

However, Cash App doesn’t support prepaid cards as a funding option. It doesn’t take PayPal either.

Can you use prepaid cards with Square’s Cash App?

No.

Other P2P Payment Options for Square Cash: With Cash App, you’re limited to a bank account, standard debit card, or credit card to send money. Like Venmo, credit card payments are the only type that comes with a fee–3% of the amount you send.

Transfers out of Square Cash: Also like Venmo, Cash App allows free ACH transfers of your balance to a bank account. Because Cash App supports transfers out using a routing and account number, prepaid cards should work if entered as a bank account. Cash App also offers instant transfers using eligible debit cards.

Zelle

Zelle was created by some of the largest banks, like Chase and Bank of America, to facilitate P2P payments between bank accounts. It differs from Venmo and Square Cash in that you don’t have a separate Zelle balance. Payments come directly out of the sender’s bank account, and recipients receive the money directly in their bank account.

For those wanting to use their bank account for P2P payments, that’s great. There’s no need to make another transfer out when you receive money. Plus, it’s free and fast. For participating banks, transfers take minutes and Zelle is typically available within the bank’s app. Zelle offers a stand-alone app and standard ACH transfers for most banks that aren’t Zelle participants.

Most prepaid users are out of luck though. Zelle only works with prepaid cards issued by “Zelle Network Banks.” Zelle Network Banks are traditional brick-and-mortar banks. Only a few offer their own prepaid cards–like the Access 360° Prepaid Card and PNC SmartAccess® Prepaid Visa® Card. That means that Zelle doesn’t accept many of the major brand prepaid cards to send money or receive it.

Can you use prepaid cards with Zelle?

Just a few of the Zelle Network Banks.

Other P2P Payment Options for Zelle: Bank accounts only. That’s what it was designed for. Credit cards, most prepaid cards, and PayPal can’t be used to make Zelle payments.

Transfers out of Zelle: Because Zelle doesn’t keep a balance, there are no transfers out. You’ll receive the money directly to your account when you accept a payment.

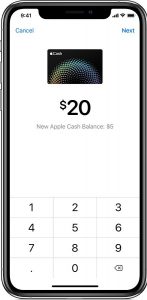

Apple Cash

Apple launched Apple Cash in late 2017 as part of its suite of financial offerings. Between Wallet (formerly, Apple Wallet), Apple Pay, and Apple Cash, it all gets a bit confusing. Here’s the primer. Wallet is an iPhone App that allows users to store various payment cards (credit, debit, and prepaid cards). Apple Pay is a contactless payment method that allows you to pay by holding your phone to a contactless payment terminal at stores. When you use Apple Pay, you use one of the payment methods stored in Wallet. Apple Cash is its own account that you set up and access in Wallet. You can transfer money to and from Apple Cash and then use it as a payment method.

For our purposes, we’re interested in Apple Cash because Apple Cash is for peer-to-peer payments. You send money through the Messages app from your Apple Cash balance. Likewise, money received through Apple Cash is added to your Apple Cash balance.

Prepaid card users that use iPhones may have a partial P2P solution with Apple Cash. You still need to have the Wallet app and set up Apple Cash. So, you can use Apple Cash to receive money from friends, and the Apple Cash balance can be transferred to most prepaid cards. If your prepaid card isn’t compatible with Wallet, just select the option to transfer Apple Cash to a bank account and use the routing and account numbers for your prepaid card.

Can you use prepaid cards with Apple Cash?

Yes, at least to fund the prepaid card. You can use Wallet-compatible prepaid cards to fund your Apple Cash balance. You can set up an Apple Cash card in the Wallet app on your iPhone.

Other P2P Payment Options for Apple Cash: You can use most bank debit and prepaid cards that support Apple Wallet.

Transfers out of Apple Cash: You can transfer funds instantly from Apple Cash to supported debit cards in your wallet. Or you can transfer funds to a bank account. To transfer funds from your Apple Cash balance to a prepaid card that doesn’t support Wallet, select transfer to bank account and enter your prepaid card routing and account numbers. It’s like transferring money from a bank account to your prepaid card.

Transferring Money Between Prepaid Cards: A P2P Option Just for Prepaid Card Users

Apart from the P2P apps, prepaid card users have another option. Many prepaid cards allow cardholders to transfer money to others using the same card. So, MyVanilla Prepaid Visa® Card cardholders can pay other MyVanilla cardholders, for example. Those transfers are typically free, but some cards do charge a fee, so check the terms.

Of course, the limitation is obvious. The sender and the recipient both have to have the same brand of prepaid card.

Netspend® Visa® Prepaid Card extends that reach somewhat, allowing cardholders to make transfers to other cards managed by Netspend, like the Brink's Prepaid Mastercard® or the Western Union Prepaid Card. To make a transfer from one Netspend card to another, you need the recipient’s “FlashPay Id.” It’s just a code that Netspend provides through your account portal. Enter the recipient’s FlashPay Id and the amount in the Netspend mobile app or the web portal, and the recipient will receive an immediate notice. Once accepted, the money goes directly to their Netspend card.

Green Dot has a similar option. You can transfer money between any prepaid cards issued by Green Dot Bank. That includes the Green Dot Prepaid or Cash Back Cards, but also the Walmart MoneyCard® Visa®, and even the Turbo Prepaid Card. It’s a bit easier with Green Dot. You just need the recipient’s email.

Summary of P2P Options for Prepaid Cards

Prepaid card users have options to use their prepaid cards with P2P apps, like PayPal and Venmo. But there are limitations. Venmo is the only fee-free app to use prepaid cards for payments. And bank accounts are still the cheapest, easiest way to get money out for any of the P2P apps.

But P2P is still in its infancy and changing rapidly. Venmo added its instant pay option just last year. And Zelle’s stand-alone app didn’t even exist until 2018. Expect to see more options for prepaid cards in the future.

But as it stands now, here are the options:

| P2P App | Use Prepaid Cards for Payment? | Allow Transfers Out to Prepaid Cards? |

|---|---|---|

| PayPal | Yes, but charges a fee of 2.9% plus $.30 | Yes. No fees. Takes 1-3 days (or instant with the PayPal Prepaid Card). |

| Venmo | Yes. No fees | Maybe. Venmo supports instant transfers for “eligible debit cards”. Fee of 1% with a $.25 minimum. |

| Cash App | No | Maybe. Cash App supports standard 1-3 days ACH transfers to accounts with routing and account number. No fees. |

| Zelle | Only those issued by Zelle Network Banks | N/A – payments are received directly in their bank account |

| Apple Cash | Limited | Yes. No fees. Takes 1-3 days. Apple Wallet supported prepaid cards may be able to receive instant transfers |

| Card-to-Card Transfers | Yes. Most prepaid cards allow payments to other cards with the same brand. Usually, no fees. | N/A – payments are received directly on their prepaid card |