KAIKU® Visa® Prepaid Card Review

The Kaiku Visa Prepaid Card offers low cost alternative to banks. With the Kaiku card, you can get direct deposit of your paycheck, pay bills online, transfer money from PayPal or Amazon, and get cash at more than 55,000 ATMs. In this review we’ll cover these features and more, which explains why Kaiku is one of our highest ranked prepaid debit cards.

Snapshot

- Low monthly fee of $3

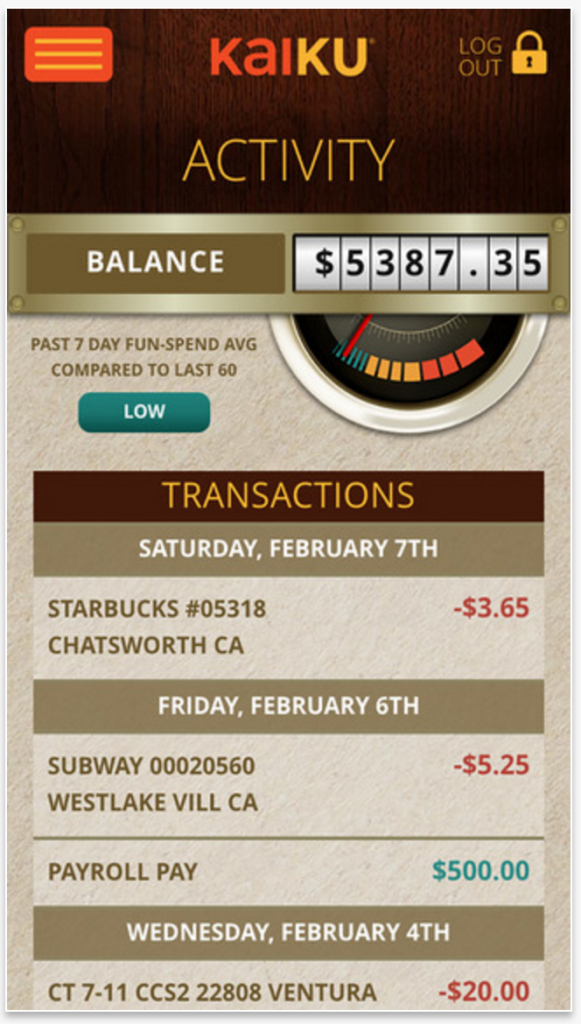

- Kaiku’s “Funds-Ometer,” app tracks card users’ spending and compares it to their average spending over the past 60 days in non-essential categories, like eating out, bars and entertainment.

- No activation fees, usage fees, card declined fees and currency conversion fees.

- Low $1.45 fee for out-of-network ATM use.

- Mobile checking loading

- Easy card to card transfers

Features

Kaiku offers a long list of features:

Direct Deposit: This is a standard feature with almost all prepaid cards. With Kaiku, you can set up direct deposit of your paycheck directly to the card.

Deposit Checks: With the Kaiku mobile app, you can deposit checks to your card. These include government benefits checks, tax refunds, and even personal checks.

Load Cash: One of the challenges of any prepaid card is loading cash. With Kaiku, you can load cash to the card at any of the thousands of Visa ReadyLink or MoneyGram locations.

Transfer from PayPal or Amazon: Kaiku enables you to transfer money from your PayPal or even Amazon account. You simply set up Kaiku as an external bank account

Card to Card Transfers: If you have friends or family with a Kaiku card, you can transfer or receive funds between cards. It’s a great way to pay allowance, give a gift, or split the check.

Pay Bills Online: Kaiku enables card members to pay bills online. You can make one-time payments or you can set up recurring payments.

Get Cash at ATMs: Finally, Kaiku is part of the Allpoint ATM network. As a result, cardholders can use more than 55,000 ATMs nationwide without paying a surcharge.

Fees

Kaiku offers one of the lowest free prepaid cards available today. And for those that load at least $750 a month on the card, Kaiku can be used for free so long as you use in-network ATMs (and there are over 55,000 of them). Here is the fee chart for Kaiku:

| Description | Fee |

|---|---|

| Monthly Maintenance | $3/month* |

| ATM Transaction (out-of-network) ‡ Waived if you use in-network Allpoint ATMs. |

$1.45/transaction‡ |

| ATM Fees (in-network at Allpoint) | No Charge |

| Bill Payment | No Charge |

| Card Purchase | No Charge |

| Card Activation | No Charge |

| Card Replacement | No Charge |

| Card Inactivity | No Charge |

| International Currency Conversion | No Charge |

* Waived if you load at least $750 each month.

| Description | Fee |

|---|---|

| ATM Fees (out-of-network) (charged by ATM operator, in addition to our $1.45 out-of-network ATM fee listed above) |

Varies |

| Cash Loading (charged by merchant) |

$2.95 – $4.95 |

| Mobile Deposit (expedited) (for immediate availability, charged by Ingo Money) |

1% or 4%, $5 minimum (varies by check type) |

| Mobile Deposit (standard) (can take up to 10 days, no charge by Ingo Money) |

No Charge |

| OTC Cash Withdrawal (charged by bank branch) |

Varies |

Smartphone App

Kaiku offers a free mobile app to very cardholder. Through the mobile app you can check your balance and your transactions. You can receive low balance alerts. you can also deposit paper checks, send money to friends, or search for ATM Visa Readylink cash loading locations.

Kaiku offers a free mobile app to very cardholder. Through the mobile app you can check your balance and your transactions. You can receive low balance alerts. you can also deposit paper checks, send money to friends, or search for ATM Visa Readylink cash loading locations.

Another excellent feature is budgeting. With the app you can set budget limits by category. The is available on Apple devices (iPhone and iPad) and Android devices.

Visa Clear Prepaid Program

Kaiku is part of the elite Visa Clear Prepaid Program. This program recognizes prepaid cards with easy to understand fees and solid consumer protections. Currently there are just eight prepaid cards that qualify, and Kaiku is one of them.