OnBudget Prepaid Mastercard Review

The OnBudget Prepaid Mastercard focuses on people that want to use a prepaid card as a budgeting tool. It has almost no fees but comes with some challenging limitations.

30% of prepaid card users cite budgeting as a key reason to use a prepaid card, according to the Pew Research Institute. The OnBudget Prepaid Mastercard seeks to target those users with its prepaid card and mobile app.

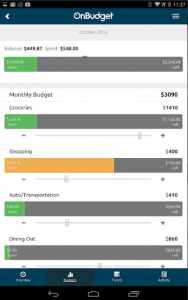

The OnBudget mobile app allows you to set spending category limits using simple sliders. Then it tracks your spending on the card and shows when you’re approaching the limit.

The OnBudget mobile app allows you to set spending category limits using simple sliders. Then it tracks your spending on the card and shows when you’re approaching the limit.

The mobile app also shows spending trends–how much you’ve spent for groceries each month, for example, and your average.

The cost of the OnBudget card is very budget-friendly. It charges almost nothing. No activation, monthly, or transaction fees. OnBudget doesn’t charge for ATM withdrawals either. But it doesn’t offer a free ATM network, so you will have to pay fees charged by the ATM owner.

Unlike most prepaid cards though, OnBudget offers no way to load cash or checks to the card. It has to be funded exclusively through direct deposit or transfers from a bank account. As OnBudget describes its card, it doesn’t seek to replace a checking account, but complement it.

The card’s low limits reflect that as well. The maximum balance on the card is $5,000, and the most that you can load to the card in a day is $2,500. For some, that may be inadequate to handle direct deposit of a paycheck. ATM limits are also lower than most other cards–$300 per day, compared to the average $500.

OnBudget Prepaid Mastercard not what you are looking for? Check out other options in our Best Prepaid Debit Cards list.

If you have a checking account, OnBudget may be a perfect fit. It’s among the cheapest options for prepaid cards. And its budget features add real value to those looking to track their spending, and it provides a slick mobile app interface to simplify set up.

But if you’re looking to a prepaid card as a checking account alternative, OnBudget won’t cut it. Without a checking account, the only way to fund the card is through direct deposit. That leaves expensive check cashing as the only option to handle the occasional check. And the lack of any cash load option means that you’ll end up carrying cash more than you would like.

Best For: Those wanting a prepaid card for budgeting in addition to a checking account

Not So Good For: Those without a checking account; those looking to load cash or checks to their prepaid card